While often used interchangeably, a Tax Incremental District (TID) and Tax Incremental Financing (TIF) have distinct meanings. Tax Incremental Districts (TIDs) and Tax Incremental Financing (TIF) collectively are economic development tools used by local governments to promote development and redevelopment, thus stimulating growth in carefully targeted areas.

A Tax Incremental District (TID) is a specific geographic area within a city or village that is targeted for development or economic revitalization (there are special statutes governing town TIDs). It is usually an underdeveloped or blighted area that requires improvements to infrastructure, public facilities, or private development to reach its highest and best use. In other words, “but for” the establishment of the TID, the desired development would not be achieved by the market alone. This is called the “but for” test.

The creation of a TID allows the local government to use the increased property tax revenue generated from the district’s growth to finance those improvements.

TIDs serve as catalysts for economic growth and revitalization. The additional development within the district contributes to the local economy, generates tax revenue, and enhances property values. Additionally, TIDs often involve infrastructure upgrades and improvements within the designated area. This can include the construction or improvement of roads, utilities, public transportation, parks, and other community facilities. By investing in infrastructure, TIDs can enhance the quality of life for residents and make the area more attractive for businesses and residents alike.

Tax Incremental Financing (TIF) is the mechanism used to fund specific development and redevelopment activities within a TID that are included in a professionally prepared and TID plan approved by the “Joint Review Board,” which is made up of representatives from the affected taxing jurisdictions and the general community. Here’s how TIF generally works:

Creation of a TID:

The local government establishes a TID by designating a specific geographic area, typically an underdeveloped or blighted property or properties in need of desired development and / or revitalization.

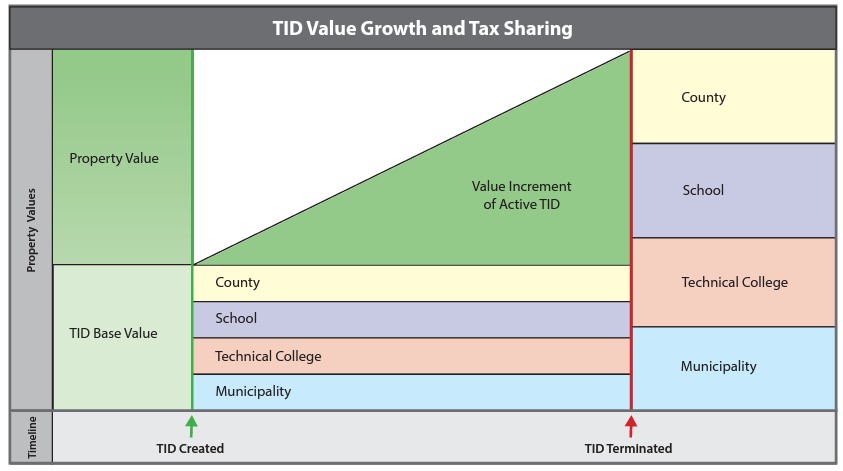

Determine Baseline Property Value:

The municipality calculates the current equalized assessed value of the properties within the TID, which becomes the base value. All taxing entities continue to receive their share of the tax revenue coming off this base value throughout the life of the TID.

Development and Incremental Value:

As new developments, improvements, or investments are made within the TID, property values tend to increase. The difference between the new value and the baseline value is known as the “incremental value.”

Captured and Invested Property Tax Revenue:

The local taxing bodies then collectively invest the increased property tax revenue generated by the incremental value in the TID.

Financing:

The redirected incremental property tax revenue is then used to pay for and / or finance various public benefit projects within the TID Plan, including roads, utilities, parking lots, parks, developer incentives or other improvements that enhance the area’s desirability and attract further private investment.

Payback Period:

The TID typically has a specified duration or “payback period” during which the incremental tax revenue is dedicated to financing eligible projects (state statute governs maximum TID life). Once the payback period ends (projects and any associated financing are paid for), the increased property tax revenue is directed back to the taxing entities except now there is much more property tax revenue reaching them due to all the new developments afforded by the TID.

Simply put, taxing entities invest in growing “the size of the pie” to the ultimate benefit of taxpayers as a whole by spreading the costs of government services across a broader tax base. Tax Incremental Districts, due to their admitted complexity, are often misunderstood and carry with them several myths. We’ll be tackling these in future articles, so be sure to follow our social channels for updates.