Your Partner in Business Expansion and Investment

At EDWC, we help businesses, lenders, and communities move from opportunity to action. Whether it’s structuring a complex financing deal, uncovering site and workforce insights, or navigating local approvals, our team works beside you to make growth possible—and sustainable.

What We Do

Why Choose EDWC?

Our success is measured by yours. With decades of experience and deep local relationships, we simplify complex projects and make your goals achievable.

I would like to take a moment to give some recognition to Leslie at EDWC. She was my main point of contact throughout this process and she is fantastic! She is kind, responsive, and professional. I greatly appreciated her flexibility and timeliness with documents when we had to change closing due to builder issues MULTIPLE times. Thanks for your help, Leslie. We really appreciate you!

Starting up a new venture is complicated and EDWC has provided positive support and great advice since we first connected with them. It’s such a privilege to be part of this community.

Our family is extremely appreciate of this grant. This helped provide us with a down payment on our home and eased the process of buying a home in a new community. We are excited to give back to the community with the incentive process.

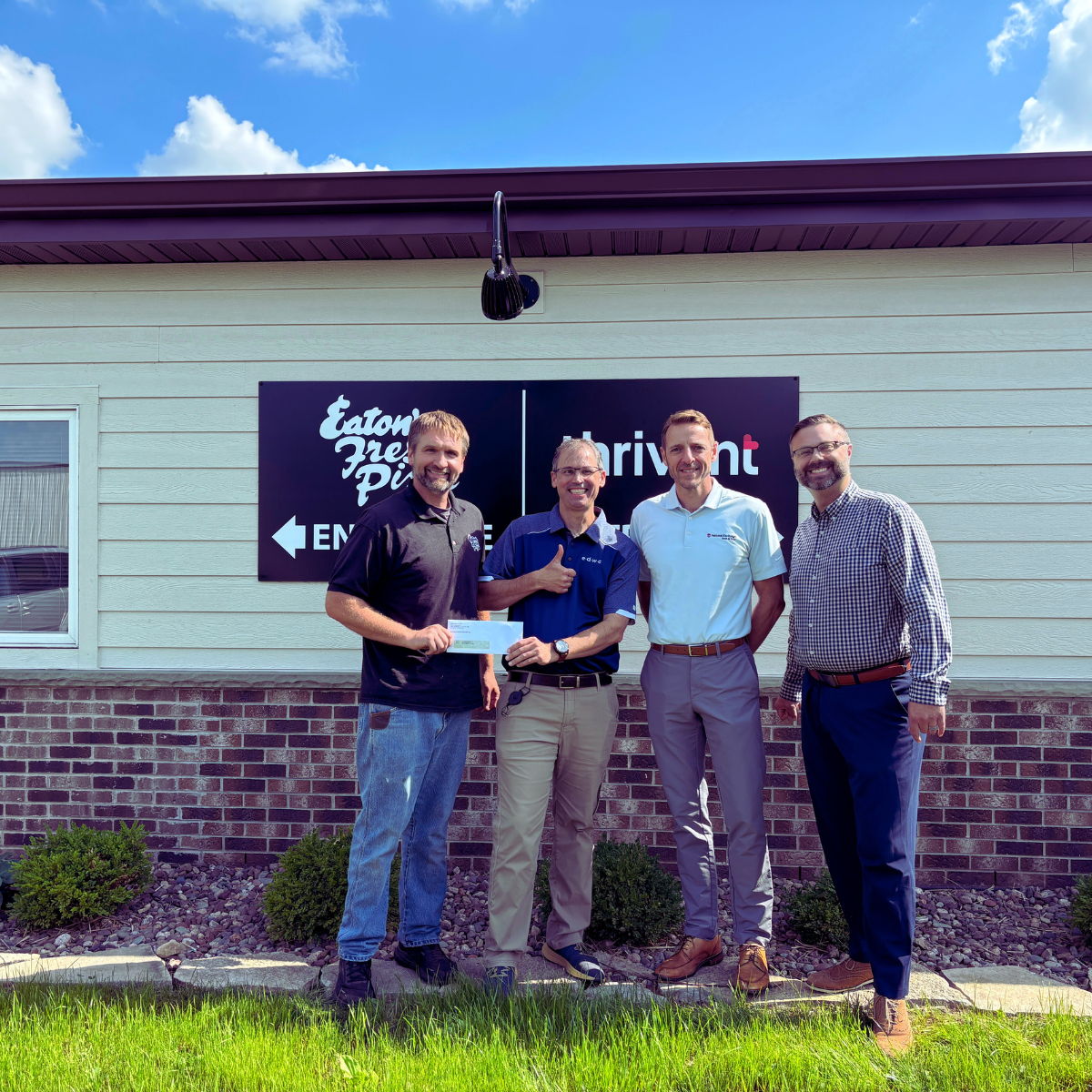

EDWC Celebrates 20 Years of Mission, Impact, and Entrepreneurial Spirit

2200 Green Tree Road West Bend, WI 53090 262-335-5769